Payment accounts terminology

Payment schemes

×![]()

| Term | Description |

|---|---|

| Payment Scheme | A payment scheme refers to a set of rules defining how payment transactions initiated through a specific payment method need to be processed. Each payment method comes with its own scheme. Examples: SEPA SCT scheme, SEPA SDD (Core/B2B) scheme, Mastercard card scheme. |

| SEPA | Single European Payments Area (SEPA) refers to:

|

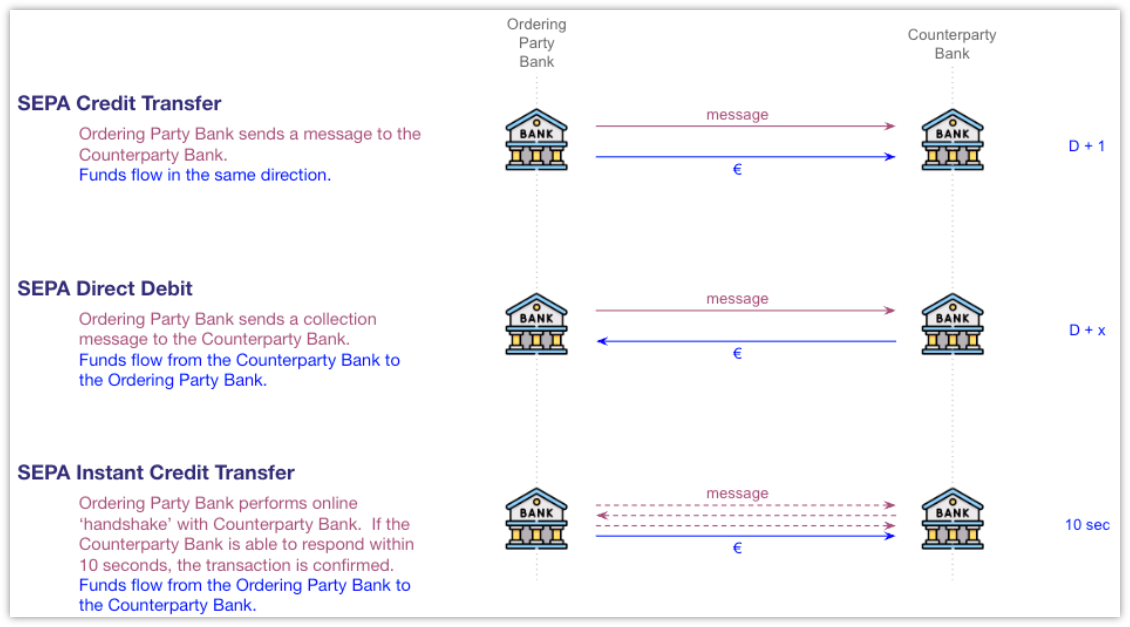

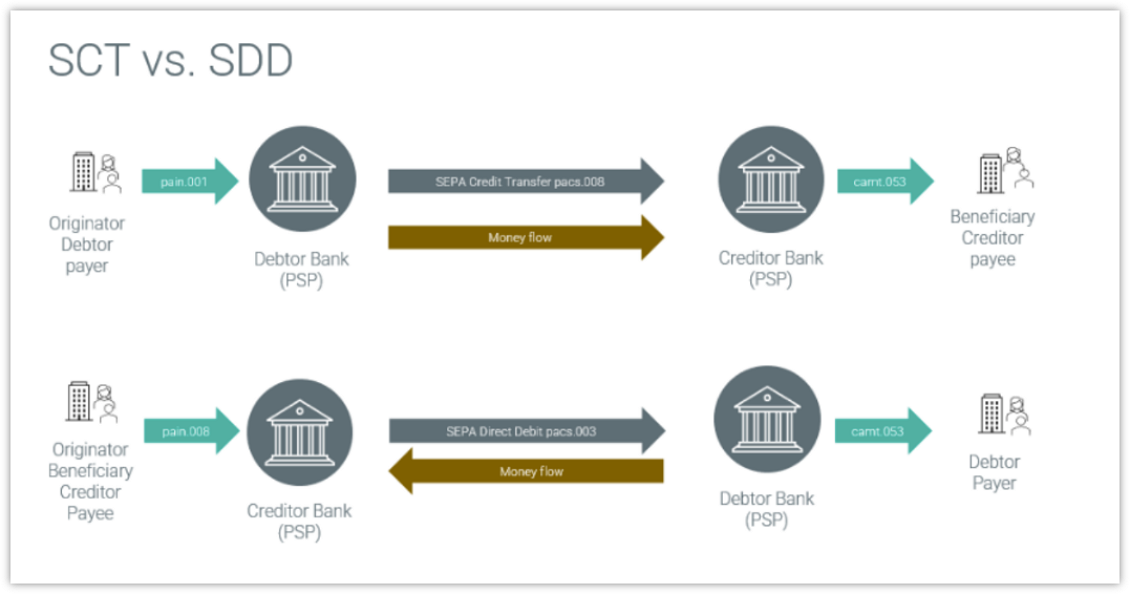

| Credit Transfer | A credit transfer (push payment or bank transfer) is an electronic account-to-account payment from one payment account to another, initiated by payers sending a request to their payment service provider to transfer money to a payee's account. |

| Direct Debit | A direct debit (or pull payment) is an electronic account-to-account payment from one payment account to another, whereby the payers give permission to the payees to take money from their account. |

| SCT | A SEPA Credit Transfer (SCT) refers to the payment method governed by rules of the SEPA scheme for making credit transfers in Euro through the SEPA area. |

| SCT Inst | An Instant SEPA Credit Transfer (SCT Inst) refers to the payment method governed by rules of the SEPA scheme for making instant credit transfers in Euro through the SEPA area. SCT Inst is available 24/7/365 and execution is done within 10 seconds. |

| SDD | A SEPA Direct Debit (SDD) refers to the payment method for one-off or recurring payments, governed by rules of the SEPA scheme, used by billers (creditors or beneficiaries), to collect funds from their customers (debtors or payers) in Euro through the SEPA area. |

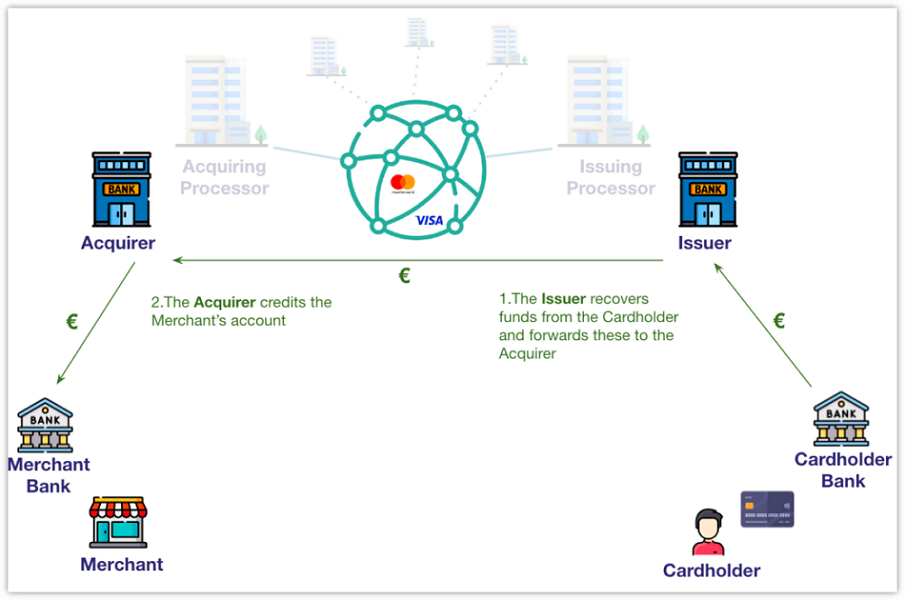

| Card Scheme | A card scheme is a payment scheme that sets the rules and standards for processing card transactions. The card scheme operates the infrastructure that allows cardholders to make payments at merchants, withdraw cash from ATMs, and conduct other types of transactions using their cards. It involves multiple parties, including card issuers, acquiring banks, payment processors, and merchants, all operating under the scheme's guidelines. Card scheme examples: Mastercard, Visa, American Express. |

Parties

| Term | Description |

|---|---|

| Debtor | A debtor (originator or payer) refers to the party owing funds to the creditor. A successful execution of the payment will result in funds being moved from the debtor's account to the beneficiary account(s). The debtor is customer of the debtor bank. |

| Initiating Party | An initiating party (ordering party) refers to the party who initiates the payment (sends a payment request).

An example of an initiating party different from the debtor: an entity administering the salary payments of a company's employees. |

| Debtor Bank | A debtor bank (debtor payment service provider or originator bank):

Note: The debtor bank does exactly the opposite of what the creditor bank (beneficiary bank) is supposed to do. |

| Creditor | A creditor (beneficiary or payee) refers to the party who receives funds after successful execution of a credit transfer or direct debit. The creditor is customer of the creditor bank. |

| Biller | A biller (in the context of SDD) refers to the creditor initiating the collection of the funds from its debtors. Example: A Telco company sending monthly instructions to debit its customers to pay their monthly invoices. The customers have signed an SDD mandate agreeing to pay their invoices via a direct debit collection by the biller. |

| Creditor Bank | A creditor bank (creditor payment service provider or beneficiary bank):

Note: The creditor bank does exactly the opposite of what the debtor bank (originator bank) is supposed to do. |

| Counterparty | A counterparty is the opposite party of a payment. From a bank customer's perspective:

|

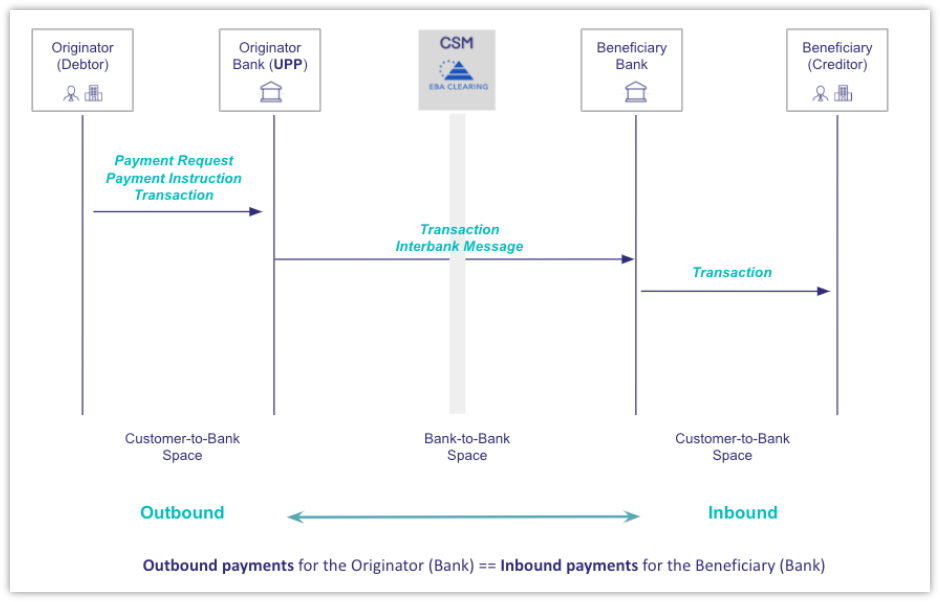

| CSM | The Clearing and Settlement Mechanism (CSM) refers to the infrastructure or system that facilitates the clearing and settlement of payment transactions. Financial institutions are connected to each other via the CSM. |

| Clearing | A clearing refers to the process of transferring information about payment transactions, reconciling transactions, the netting of transactions and the calculation of final positions for settlement. |

| Settlement | A settlement refers to the actual funds transfer between financial institutions. This is typically done via accounts that financial institutions have to open at a central bank. Example: ECB for SEPA payments. |

Payments

SCT Payments

| Term | Description |

|---|---|

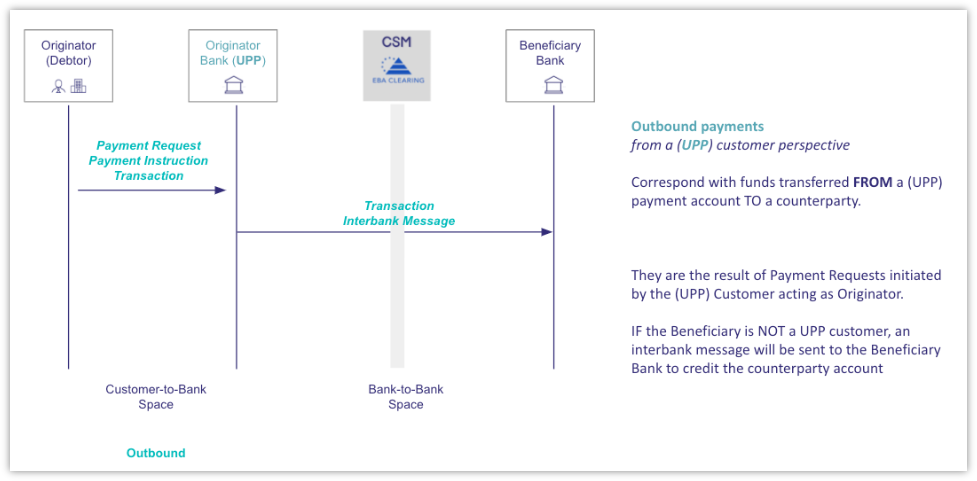

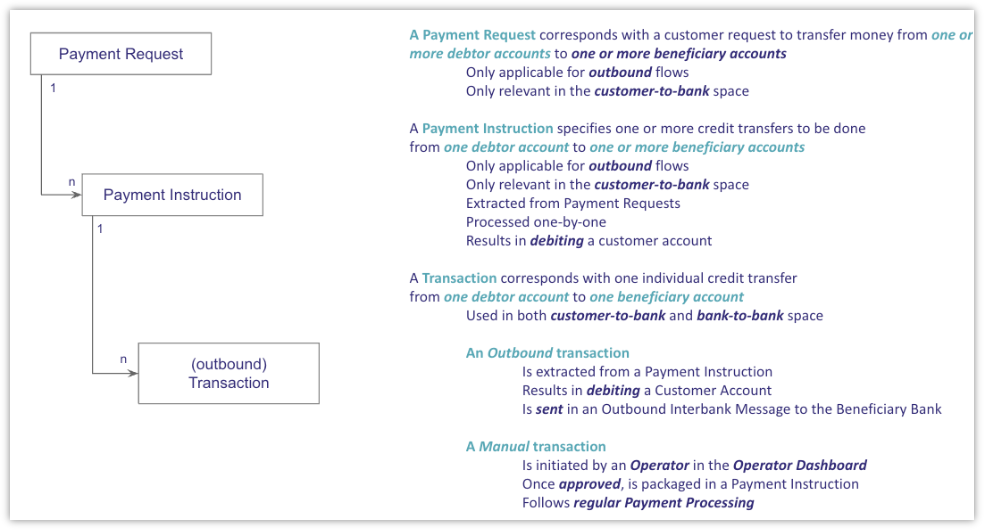

| Payment Request | A payment request corresponds to a customer request to transfer money from one or more debtor accounts to one or more beneficiary accounts. Example: A payment initiation file (PAIN.001) sent by a third party/large corporate requesting payments to be executed from several debtor accounts. |

| Payment Instruction | A payment instruction specifies one or more individual credit transfers from one debtor account to one or multiple creditor accounts. It is extracted from a payment request. The processing of a payment instruction results in debiting a customer account, i.e. in one or more account debit movements. |

| SCT Transaction | An SCT transaction refers to an individual credit transfer from one debtor account to one beneficiary/creditor account. A transaction can be accepted or rejected:

|

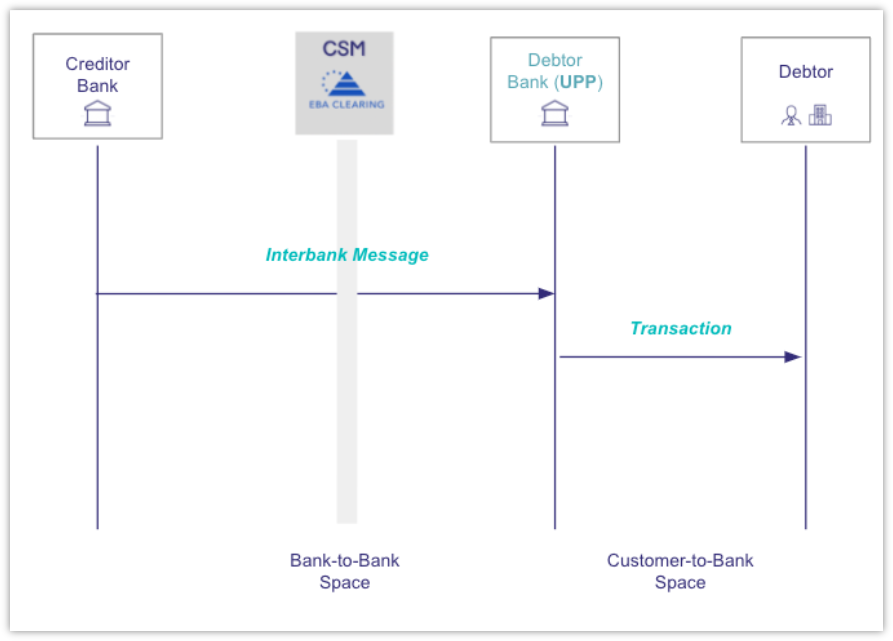

| Outbound Transaction | An outbound transaction corresponds to outgoing funds and, when executed successfully, results in a debit movement on a customer payment account. |

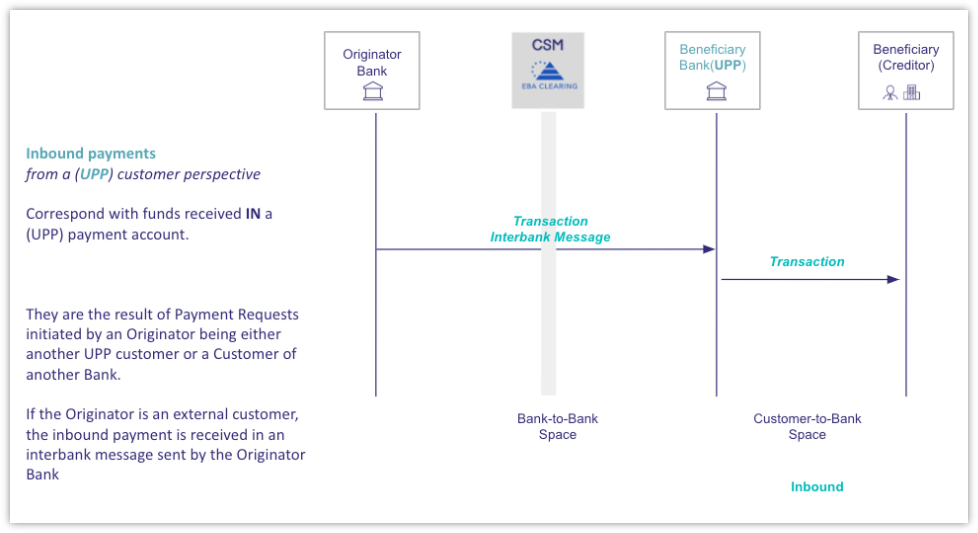

| Inbound Transaction | An inbound transaction corresponds to incoming funds and, when executed successfully, results in a credit movement on a customer payment account. |

| On-us Transaction | An on-us transaction (or intra-bank transaction) can be executed immediately and results in moving funds from one customer payment account to another customer payment account. This transaction does not need to pass via a clearing system. Only transactions between payment accounts of the same country are treated as ‘on-us'. |

| R-Transaction | An R-Transaction (or Related Transaction) is used in exception handling. It always contains a reference to the original transaction that could not be processed as expected. Each payment scheme comes with its own set of R-Transactions, and its related processing rules. Examples: |

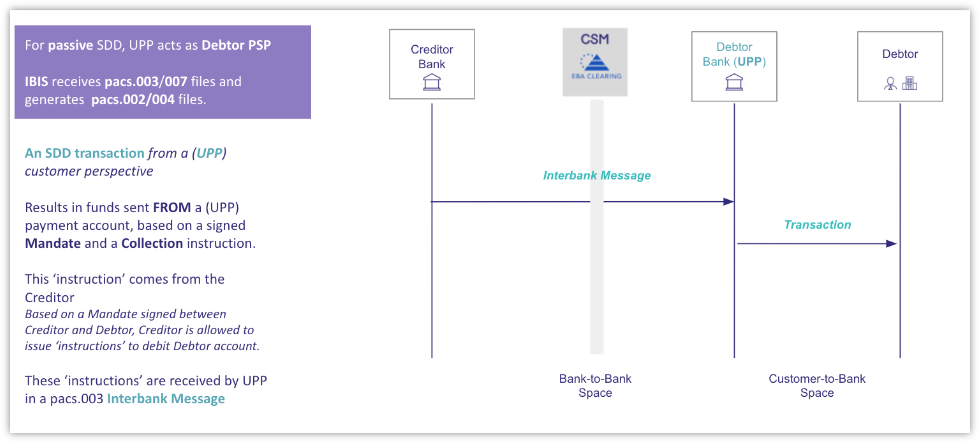

SDD Payments

| Term | Description |

|---|---|

| Active SDD | An active SDD refers to the part of the SDD flows and rules that need to be handled by the creditor payment service provider, initiating the collection of funds on behalf of the creditor/billers. |

| Passive SDD | A passive SDD refers to the part of the SDD flows and rules that need to be handled by the debtor payment service provider, receiving the instructions to collect funds from its customers, the debtors. |

| (SDD) Collection | An SDD collection is an instruction given by a creditor/biller to collect funds from a debtor account at a certain date (the settlement date). |

| SDD Transaction | An SDD transaction is created to debit an account for a certain amount, when a collection instruction is executed. |

| Settlement Date | A settlement date refers to the date when the SDD collections are settled between a creditor payment service provider and debtor payment service provider. |

| Debit Date | A debit date refers to the date when the SDD collection is executed and the debtor account debited. The debit date is usually the same as the settlement date but can be different. Example: On settlement date D, there are not enough funds available on the account to debit the requested amount. If enough funds are available on day D+1, the collection can be executed, an SDD transaction is created, the debit date = D+1. |

| (SDD) Mandate | An SDD mandate expresses the consent of the debtor to the creditor to allow the creditor to initiate collections for debiting the specified debtor's account. |

| SDD Core | SDD Core refers to the Sepa Direct Debit scheme designed primarily for consumers. |

| SDD B2B | SDD B2B refers to the Sepa Direct Debit scheme exclusively designed for businesses, with stricter rules. |

Card Payments

| Term | Description |

|---|---|

| Card Transaction | A card transaction is a transaction that involves the use of a payment card (such as a credit card, debit card, or prepaid card) to authorize the transfer of funds from the cardholder's account to a merchant or service provider or another person. Card transactions, when executed successfully, result in debit or credit movements on a payment account. |

| Card Issuer | A card issuer refers to a financial institution offering payment cards (such as credit cards, debit cards, or prepaid cards) to consumers or businesses. The card issuer is responsible for managing the cardholder's account, authorizing transactions, and ensuring the proper processing of payments. Banqup Payments plays the role of card issuer, offering debit cards to its customers. |

| Reservation | A reservation is created for a certain amount, when a cardholder initiates a payment with a card. This amount reduces the available balance of the payment account. When the card transaction is completely processed by the card network (this can take up to a few hours), the reservation is lifted, the account is actually debited and the booked balance is reduced. Examples:

|

| ATM Transaction | An ATM transaction is a self-service operation conducted through an Automated Teller Machine enabling customers to perform a variety of financial tasks, such as withdrawing cash, checking account balances, depositing money, and transferring funds. |

| Cash Withdrawal | A cash withdrawal is a type of card transaction executed at the ATM to take out cash. |

| POS Transaction | A POS or Point-of-Sale transaction occurs when a customer makes a purchase and pays for goods or services at a physical location or online in the context of e-commerce. |

| OCT Transaction | An original credit transaction (OCT) is a card transaction backed by Visa and Mastercard that allows a party (merchant or natural person) to directly transfer funds to the card of a cardholder. |

| Card Refund | A card refund transaction is a type of card transaction used by a merchant to return funds to a customer's credit or debit card after an original purchase transaction has been completed. This is typically done when a customer returns a product or cancels a service. |

| Card Chargeback | A card chargeback transaction is a reversal of a transaction initiated by the cardholder's card issuer, usually in response to a dispute raised by the cardholder. Unlike a refund, which is initiated by the merchant, a chargeback is initiated by the cardholder's payment service provider when the cardholder contests a charge on their account. Chargebacks are designed to protect consumers from unauthorized transactions, fraud, or dissatisfaction with the goods or services received. |

| Acquirer Fee | An acquirer fee is a fee set by the acquirer and collected from its merchant. This fee is typically a percentage of the transaction amount, plus a fixed fee per transaction. The acquirer fee covers the costs associated with facilitating the transaction, including the use of the payment network, risk management, and other services provided by the acquirer. |

| Interchange Fee | An interchange fee is set by the card scheme and sent from the acquirer to the issuer to compensate for some of the costs of processing the card transactions. From the issuer point of view it is a revenue. |

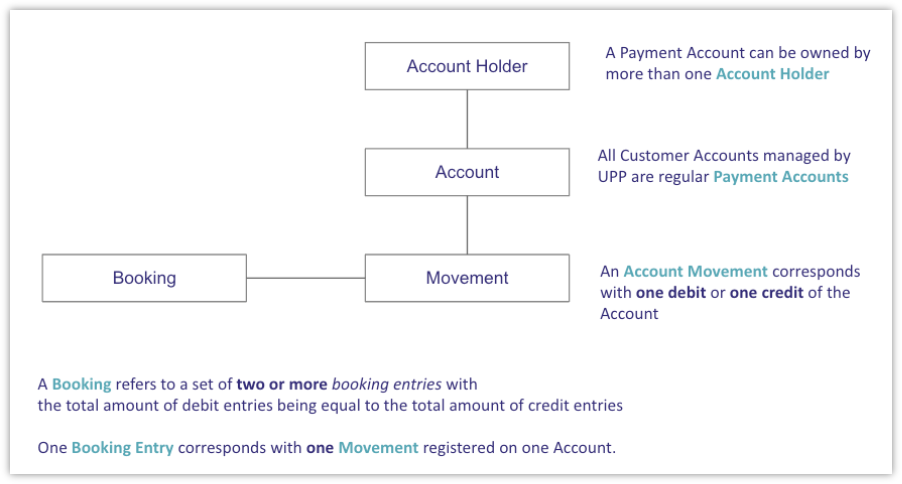

Payment accounts

| Term | Description |

|---|---|

| Payment Account | A payment account is an account, held by one or more payment service users that is used for the execution of payment transactions. As payment institution, Banqup Payments is only allowed to operate current accounts, no savings accounts, deposit accounts or any other account type. |

| Payment Institution | A payment institution is a financial institution authorized to provide and execute payment services. They may hold payment accounts which are used exclusively for payment transactions. As opposed to banks, payment institutions are not engaged in other traditional banking services such as deposit-taking, lending activities or investment management. |

| UPP Account | A UPP account (UPP payment account or PANX account) is a payment account issued and operated by Banqup Payments, similar to an ING or a Revolut account. It is sometimes referred to as a PANX account, PANX being part of the official SWIFT BIC codes for UPP payment accounts: PANXBEB1 for Belgium, PANXNL22 for NL etc. Note: Banqup Payments was established in 2016 under the name of PAY-NXT. The BICs assigned by SWIFT were based on this company name. |

| Account Holder | An account holder is a legal or natural person who owns a payment account.

|

| (Account) Movement | See the description here. |

| Credit (Movement) | A credit or credit movement on a payment account corresponds to incoming funds on the payment account increasing the booked balance of the payment account. |

| Debit (Movement) | A debit or debit movement on a payment account corresponds to outgoing funds from the payment account decreasing the booked balance of the payment account. |

| Booked Balance | The booked balance corresponds to the total amount of all debit and credit movements actually booked on the account. |

| Available Balance | The available balance corresponds to the amount on an account, available for outbound transactions. The available balance takes into account amounts that are reserved for ongoing transactions, such as cash withdrawals or card payments. It is computed as (booked balance - reserved amount). |

| Reserved Amount | An amount reserved for one or more initiated transactions waiting to be confirmed and not available for newly requested transactions. Once an initiated transaction is executed, the reservation is lifted and the account debited. Example: After a successful POS card payment, the amount of the payment is reserved and cannot be used for other payments anymore. The actual debit of the account for this amount typically happens a few hours later (when the card transactions are processed by the cards scheme). |

| Account Statement | An account statement is an official document generated by the owning financial institution listing:

Account statements are mainly used by accounting software to facilitate the accounting of SMEs and (large) corporates. It is less used for consumers. |

| Booking | A booking refers to a set of two or more accounting entries created for one accounting event:

|

| Booking Date | A booking date refers to the date on which a movement is actually booked on a bank's accounting books. All movements booked on a payment account on a certain booking date, define the closing balance of that booking date. |

| End to End Identification | An end to end identification is a unique identification assigned to a transaction by the initiating party in order to unambiguously identify the transaction. This identification is passed on, unchanged, throughout the entire end-to-end chain. This E2E Id can be used for automated reconciliation or to link tasks relating to the transaction. The E2E Id is a technical identification, not shown on user readable account statements (but part of the account statement formats imported in accounting software). |

| Creditor Reference | A creditor reference (or remittance information) is added to a credit transfer by the initiating party and contains information to enable the matching of an account movement with items to be settled, like invoices. Unlike the End to end identification, the creditor reference is included in (user readable) account statements allowing both parties to check which invoice or transaction (ATM withdrawal, card payment in a shop, fee payment, recurring payments, etc.) is settled by this entry. The remittance data supplied by the originator in the credit transfer instruction must be forwarded in full and without alteration by the originator payment service provider and any intermediary institution and CSM (Clearing and Settlement Mechanism) to the beneficiary payment service provider. The beneficiary payment service provider must also deliver received remittance data in full and without alteration to the beneficiary. Creditor Reference Type: can be structured or unstructured. Structured references are very common in some countries (BE), less common but available in other countries (NL), and not used at all in many countries. They have a predefined format and usually contain a check digit allowing automatic validation by applications. Banqup Payments supports BE, NL and the generic EU structured reference types. Creditor Reference Value: refers to the actual reference value. Examples:

|